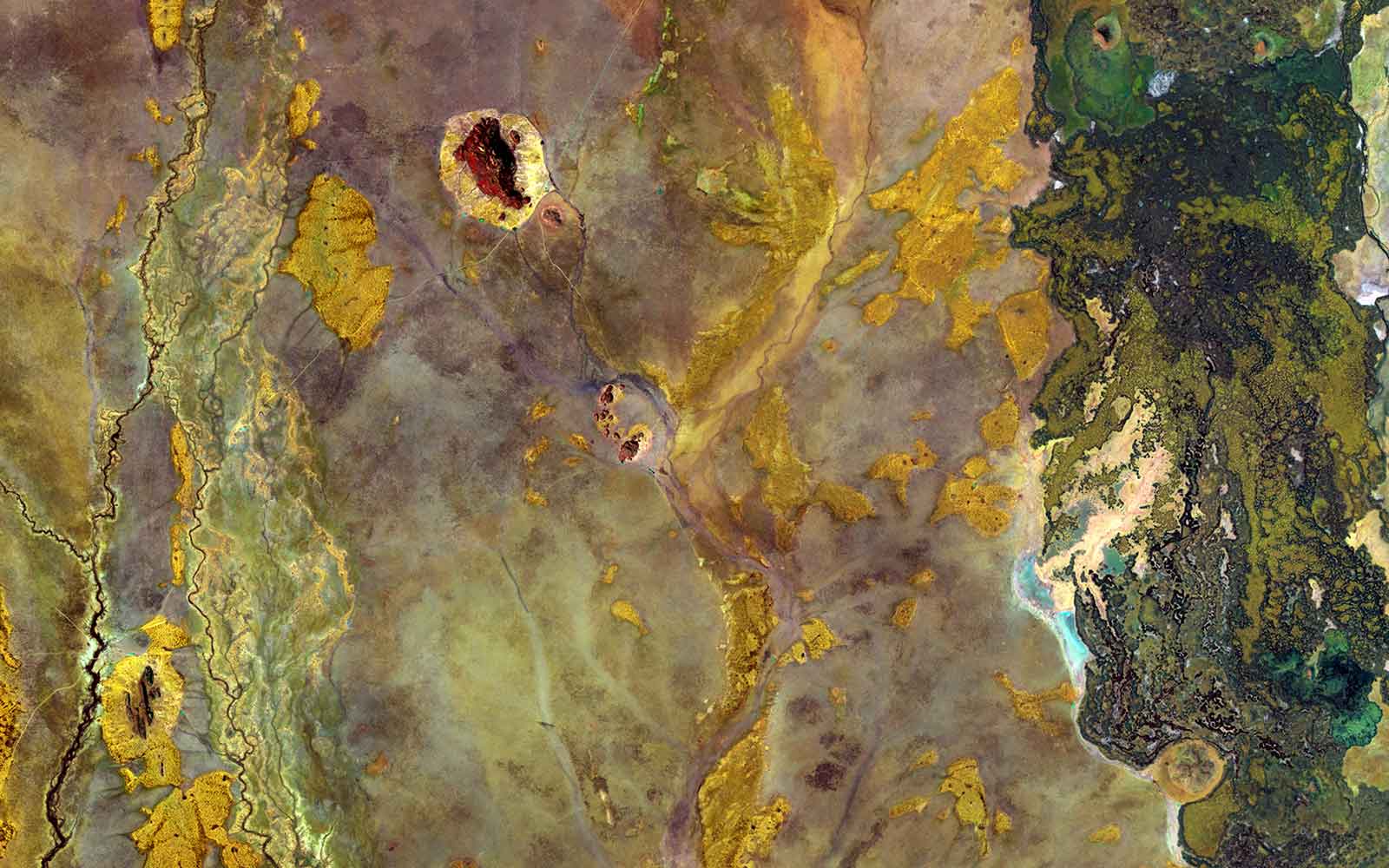

Impact Investing is the largest investment opportunity of all times.

A multi-trillion annual opportunity

For climate-related investments only, USD 4,000bn should be deployed annually over the next decade, representing eight times the current investment level:

- Achieving the Paris Agreement: up to USD 3,800bn is required annually until 2050 for energy supply only (source: Intergovernmental Panel on Climate Change).

- Adaptation to climate change: USD 180bn is required annually until 2030 (source: Global Commission on Adaptation).

Impact Investing rationale

- Public opinion and cost of environmental risks support a strong demand for Impact Investing, particularly from insurance companies, pension funds, family offices and private banks.

- Demand is high for ESG investing in Public Markets; however, such opportunities provide limited environmental benefits, as listed companies are rarely pure impact players and are flawed by legacy liabilities and business models.

Private Markets rationale

- Demand for Private Markets investing is strong, as the sector has a long history of superior financial returns over Public Markets.

- Private Markets currently contribute 60% of global climate-related investments; this share should increase, as governments pledges fall short of the amount of capital required to achieve the Paris Agreement and public spending will be limited due to countries balance sheets being generally over-levered.

Going beyond ESG by investing in genuine impact opportunities.